Why Indecision Is a Struggle, Especially With ADHD - and How Specialized Help Can Make a Difference

In the maze of an ADHD mind, indecision isn't just a stop—it's a whirlwind tour. Indecision is a challenge many face, but it's an especially...

TLDR: The market was consistently inconsistent in 2022, kind of like many of our maddening ADHD brains 😀. The market has ADHD from time to time, but by and large, the more you zoom out, the market looks more like our "neurotypical" peers and performs consistently (something we don't know much about!). While 2023 may still be a volatile year for the stock market, I think it will be more like a properly medicated ADHDer, and not an unmedicated chaotic mess (not that all ADHDers without meds are chaos! You know who you are.) In other words, in 2023, I believe the market will find its footing as inflation continues to ease and interest rates stop going up so fast.

If the stock market had ADHD, 2022 was the year it proved it. Dow Jones Market Data tells us that the S&P 500, composed of the 500 largest publicly traded companies, had more days where the price went up or down by 2% or more than it did in 2020. You know, the year that the world was swept over by COVID-19. The 46 moves over 2% are about four times the 10-year average of 11 moves over 2% per year. This is telling. So, what gives? Why is the market acting so inconsistently? Our ADHD brains are inconsistent enough as it is. We don’t need our investments working this way! Unfortunately, however, this comes with the territory of investing. Want to read more? Then keep reading!

Equity Market Performance

| Index | December Return | 2022 Return |

| S&P 500 | -5.9% | -19.44% |

| Dow Jones | -4.17% | -8.78% |

| S&P Mid-Cap 400 | -5.72% | -14.48% |

| S&P Small-Cap 600 | -6.89 | -17.42% |

Source: S&P. All performance as of December 30, 2022

But it’s not a large territory in the world of investing. Let’s say the Earth represents stock market investing in general. The part of the planet that represents years of ridiculous market volatility is as big as Australia. That’s it. And I just made that up. But the point is, the market occasionally drives us nuts. Sometimes there are years when our 401k takes a big hit or our Roth IRA that we, against all ADHD odds, diligently contributed to all year crumbles. And that’s okay. Because time and time again, the market has ultimately pulled itself together and inevitably regained its grip on a steady march higher.

Why am I so confident the market will, yet again, regain its grip and head higher? As much as market pundits will want to overcomplicate this, it is simple. It is because, for all its flaws, capitalism works. Capitalism works because it is always incentivized to do what it must do to survive during the hard times and thrive during the good times. When financial conditions get rocky like they are now, the companies that we are investing in within our 401ks, the companies that you may work for, are working hard to make the moves that will help weather the storm and rebuild a solid foundation to grow when conditions get better.

And why are those financial conditions causing the pain in the first place going to get better ultimately? This is because, just as the companies dealing the bad conditions must weather them, there are institutions, such as the Federal Reserve, whose only purpose is to do what it takes help them improve.

Companies, institutions like the Federal Reserve, and capitalism at large only sometimes and often do not get it right. Kind of like how I very often do not get it right when I try and wake up early two days in a row to start a new routine. Our system is human because humans built it, and humans often do not get it right!

But humans have a unique ability to keep fighting, surviving, adapting, and pivoting until we get it right, and I have faith that pattern will continue.

So what are the “bad” conditions, and are they improving?

The conditions that have brought on all this volatility are high inflation and higher interest rates. But good news! Inflation is dropping, if slowly. Employment is lower but strong, which supports the economy, and GDP (if the economy were one big store, GDP would be the total sales) returned to positive. And what is likely the most significant cause of the volatility is the Federal Reserve’s moves on interest rates and the messaging from Chairman Powell and the Fed Governors. The Federal Reserve can adjust interest rates, raising interest rates to slow down an economy that is growing too fast or lowering them to heat up an economy that is growing too slow or even shrinking! The current issue is that the market worries that the Federal Reserve is raising interest rates too fast to fight inflation!

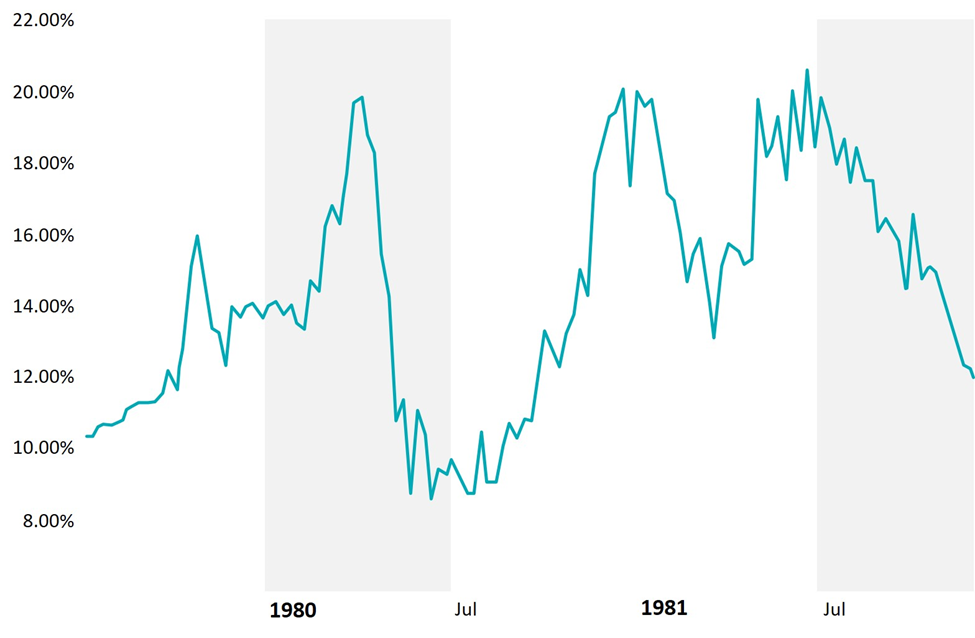

You see, one of the worst things for an economy is when there is high inflation and slow economic growth. Usually, high inflation is accompanied by fast growth. However, because of the pandemic, the government printed trillions of dollars and pumped them into the economy, which helped to create inflation artificially that continued even as the economy slowed. To fight inflation, the Federal Reserve is now raising rates. But what does this also do? It slows the economy! So we are in a tricky situation of how to get rid of inflation and not sink the economy. The market is worried that the resulting recession could be bad if the federal reserve overdoes it. In the chart below from the early 1980s, you can see how the interest rate was raised quickly, only to be cut quickly, and then raised quickly. Something like this is what we want to avoid!

Source: Macrotrends.net, Fed Funds Rate 62-year Historical Daily Level

At the moment, things are looking promising! Inflation is easing, and the economy is holding up but not heating up. This means that the Federal Reserve may be able to slow the pace of rate increases and “land” the economy softly into a mild recession, or potentially no recession at all! Either way, a mild or even standard recession is a natural part of the business cycle, and it’s nothing the market doesn’t already expect to happen. This means that once there is more clarity on the way forward, the market will be able to settle down, find its grip, and begin heading up again.

I believe 2023 will still have a bit of volatility, but I expect it to be a better year than 2022. I would not be surprised if the market posted solid gains in 2023 and acted slightly less ADHD.

What should you focus on?

Well, you shouldn't worry about anything I just wrote. You should focus on your goals and what you can control. If you are early in your investing journey, what matters more than anything is how much you are saving. If you are late in your journey, check to make sure your asset allocation (mix of bonds and stocks) makes sense and that you are not taking on too much volatility! 2023 is your year. You got this.

In the maze of an ADHD mind, indecision isn't just a stop—it's a whirlwind tour. Indecision is a challenge many face, but it's an especially...

When we think about wealthy people, it's easy to assume that their fortunes stem from family inheritances, lucky breaks, or some extraordinary...

Let me set the stage: your sink is full of dishes and you would rather die than load them into the dishwasher. Your laundry is overflowing and you...