My Feel vs. Real Journey

In golf, there is a phenomenon of feel versus real. I know about this well. About three years ago, an occasional weekend activity somehow turned into a borderline obsession as I dove deep into the realm of improving my golf swing. After three years of buying dozens of training aids, watching hundreds of Youtube videos, and filming hundreds of videos of my golf swing, I have only an eleven handicap to show for it. Granted, I started at a twenty-five index, so it's a definite improvement from a percentage decrease perspective..png?width=2880&name=ad%20(4).png)

Even at a twenty-five handicap, I thought I was naturally athletic and that all I lacked was consistency. Well, when I first looked at my swing on camera, I could not believe how ugly it was! I used an app to analyze the positions and compared myself to many pros, and it wasn't good.

I felt I had "lag". I had no lag.

I felt I had rotation. I had very little.

I felt like I stayed in posture. Nope. I was a big-time goat humper.

I felt I had "shaft lean" at impact, getting a nice compressed golf shot. Nope, I scooped the ball like I was making an ice cream cone.

Feel and real rarely ever line up in golf. To this day, I still grind on my golf swing whenever I get some spare time. And it amazes me how some of my best feeling shots look like total garbage on camera. I am a tough critic, though.

Feel vs. Real Investing

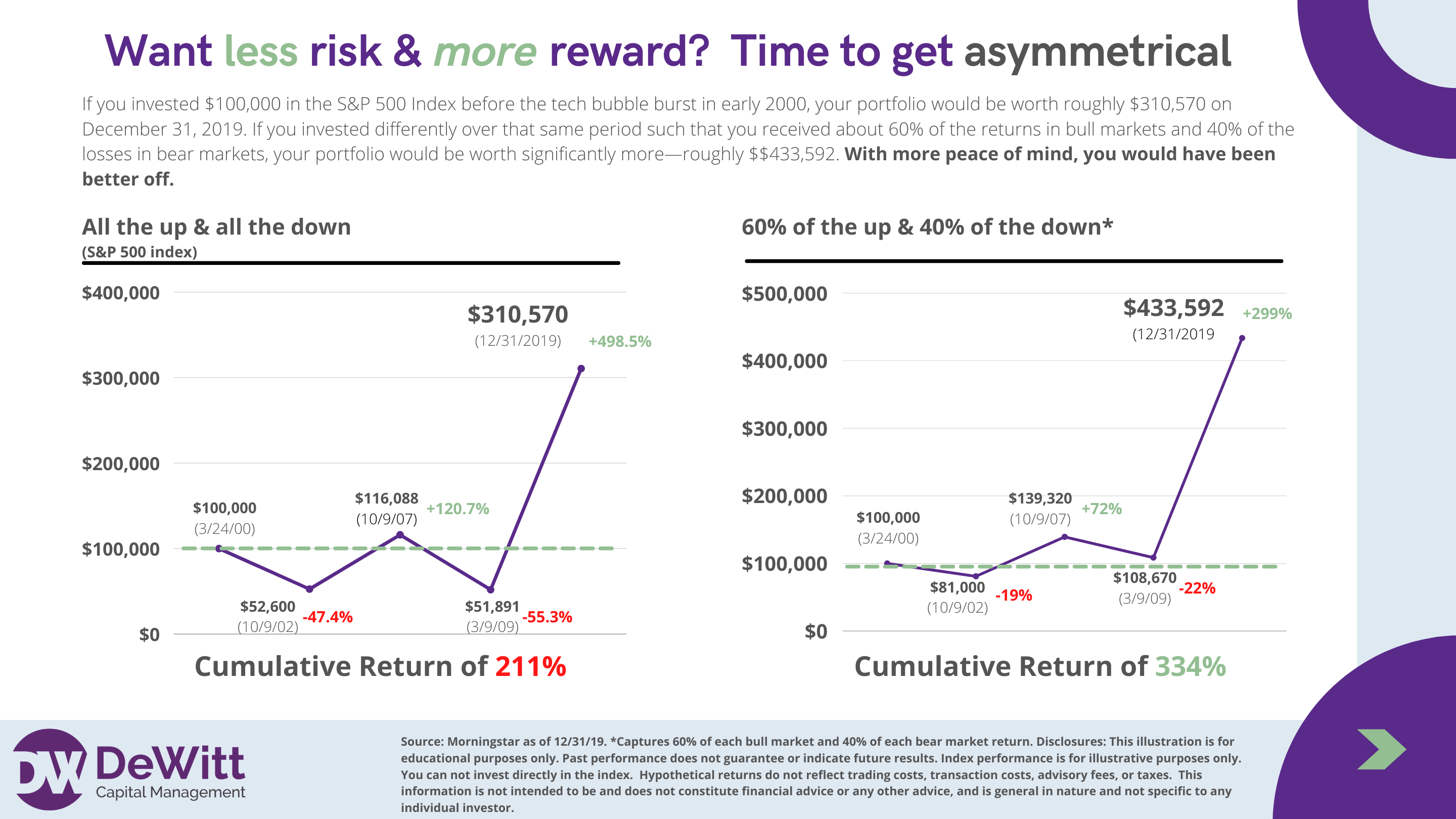

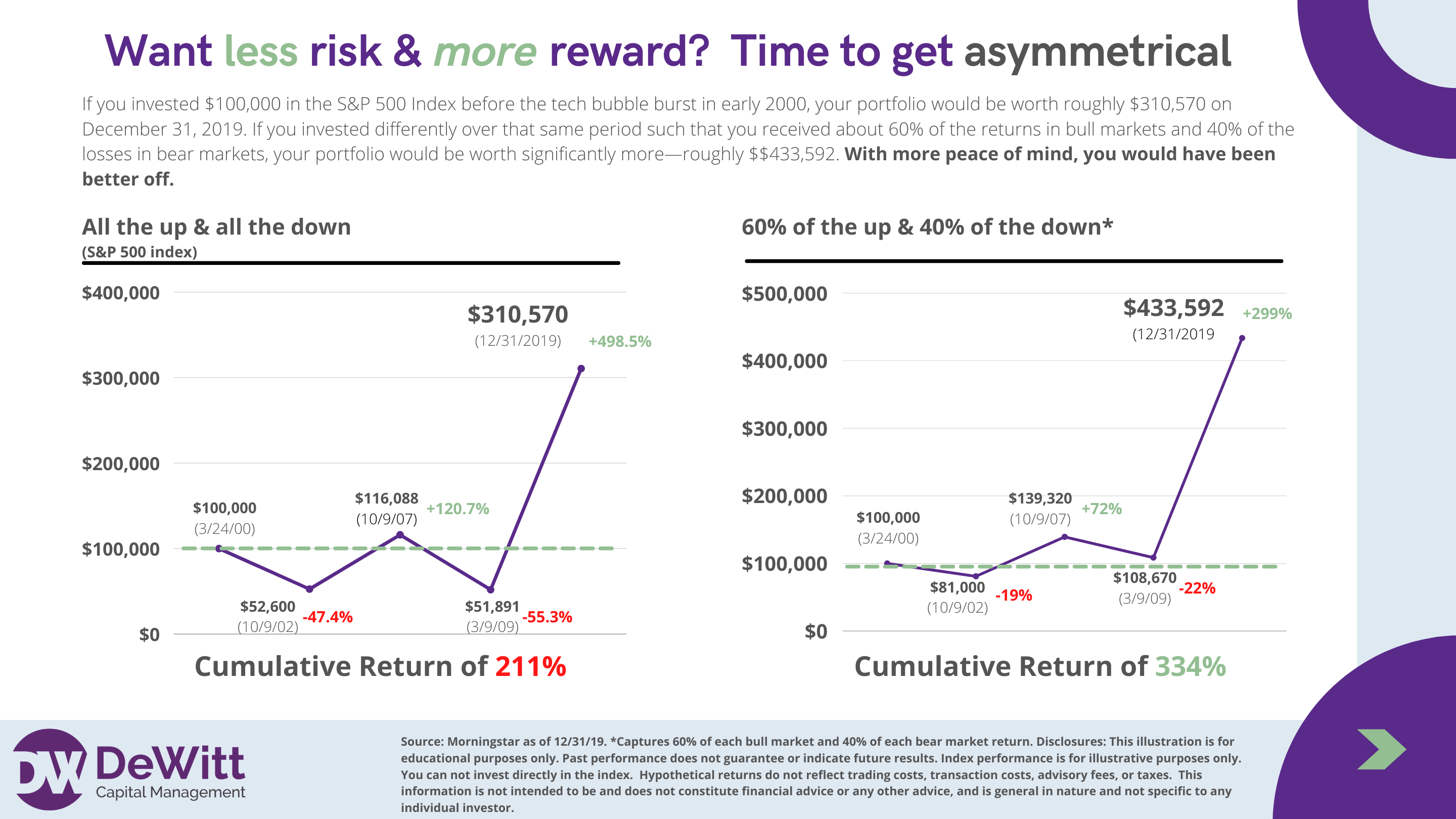

I somehow got the idea to compare this concept to investing. Investing can be such an emotional drain, even when you are doing well. What might be the best for your long term outcomes might feel disappointing at the moment. I love to preach the benefits of investing in a portfolio whose objective is an asymmetric return profile. Wait, what? That means we want portfolios to be boring in lousy markets and less boring in bull markets. If you can achieve this on average over a long period, it may be a fantastic way to reach your financial goals. Both from a literal dollar sense and in an investment-life balance sense, so long as you buy-in to the philosophy. You see, this is where the feel vs. real comes in. There will be many years, heck, maybe even every year, where it didn't feel like you did that great. The portfolio is designed to be like this. Your investments stay boring but on track so you can focus on what's important in life, like improving your golf swing. (or family) And at the end of the day, you will have real financial results.

If you can achieve this on average over a long period, it may be a fantastic way to reach your financial goals. Both from a literal dollar sense and in an investment-life balance sense, so long as you buy-in to the philosophy. You see, this is where the feel vs. real comes in. There will be many years, heck, maybe even every year, where it didn't feel like you did that great. The portfolio is designed to be like this. Your investments stay boring but on track so you can focus on what's important in life, like improving your golf swing. (or family) And at the end of the day, you will have real financial results.

Hey golfers, subscribe to our newsletter for monthly insights into the market.

.png?width=2880&name=ad%20(4).png)