The lowest 2021 S&P 500 large bank price target is 3800, which is essentially where we are. In 12 of the last 15 years, the consensus end of year S&P 500 price target has been overestimated. Being bullish is good for business and a safe choice for analysts when everyone is following the herd. We discuss this in our latest episode. We also look at the valuation of the market at levels hard to justify even in this low rate environment. We discuss Jeremy Grantham's piece from early January about the nature of bubbles and why he believes we are in a bonafide bubble at the moment. Finally, we answer a listener question about what to do with the cash you want to buy a house in a few years.

Articles Discussed:

Wall Street analysts make a big S&P 500 call for 2021. Market history says ignore them

Goldman says the bull market is still in the early stages, gives six trades to play it

Short seller Carson Block says rolling bubbles that keep popping up show fragility of stock market

WAITING FOR THE LAST DANCE

Charts Discussed:

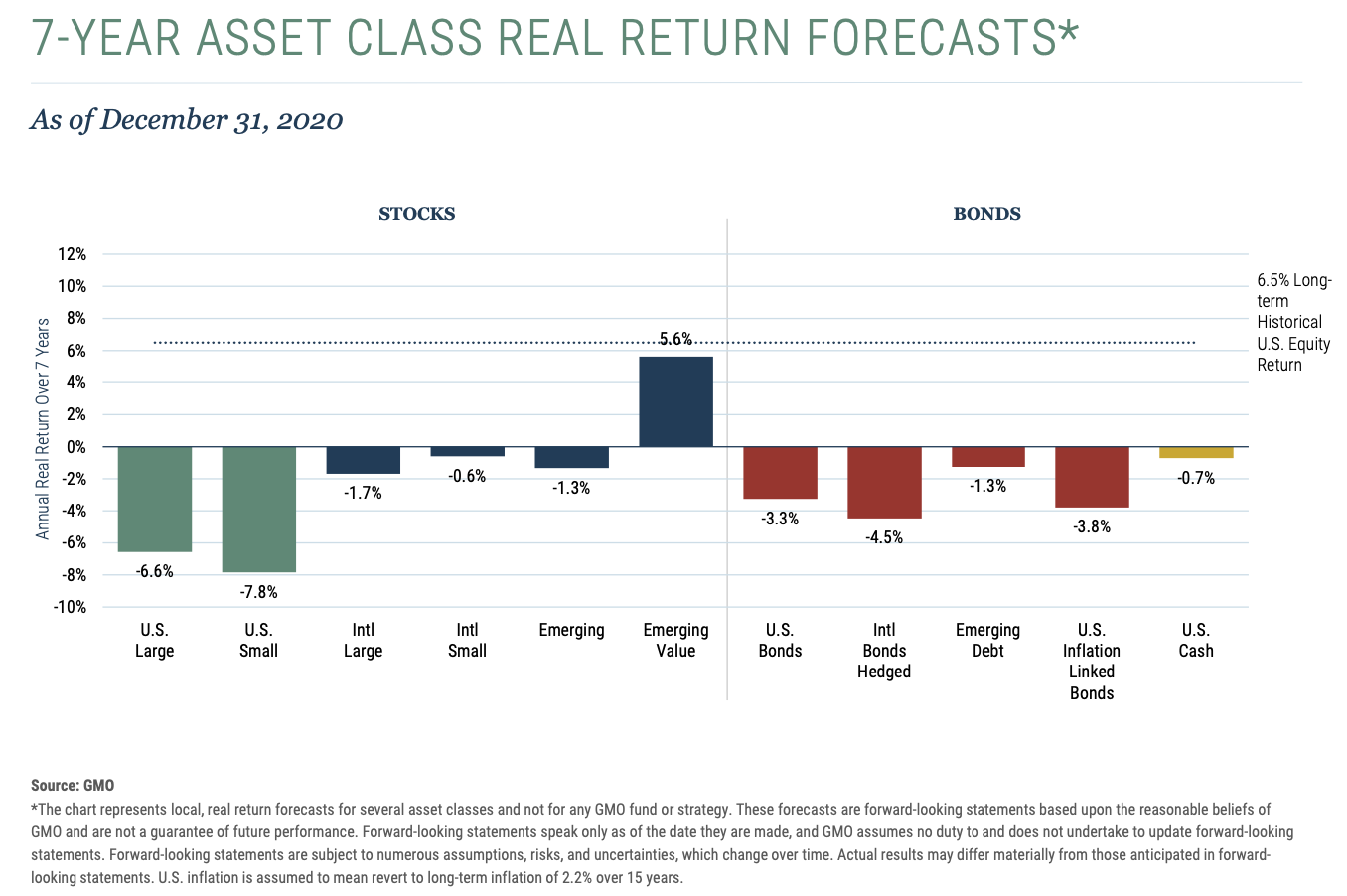

As you can see, the range out 2021 price targets goes from neutral to bullish.

Source: CNBC

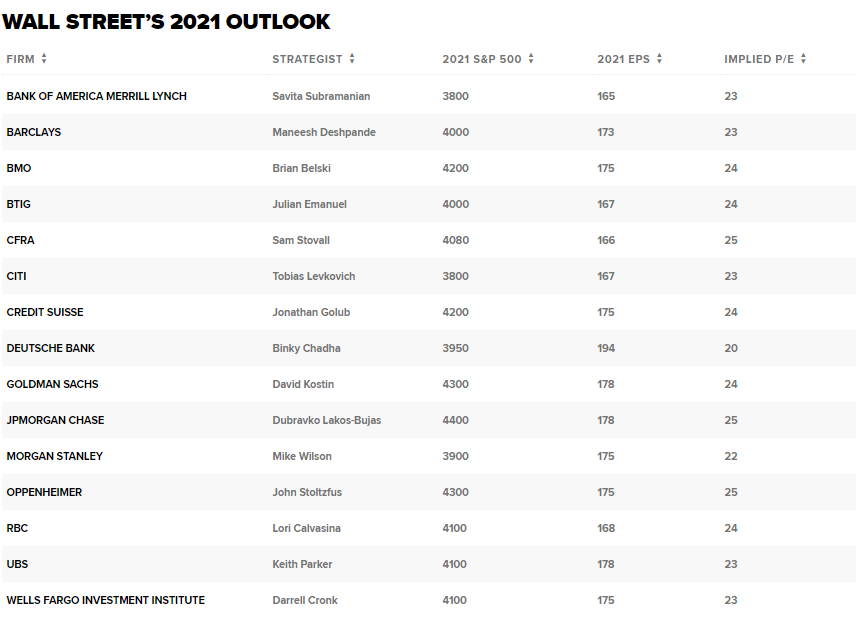

In the chart beow, you can see how high forward p/e does not predict next years returns well, but it is more reliable on a five-year annualized look.

Source: JP Morgan

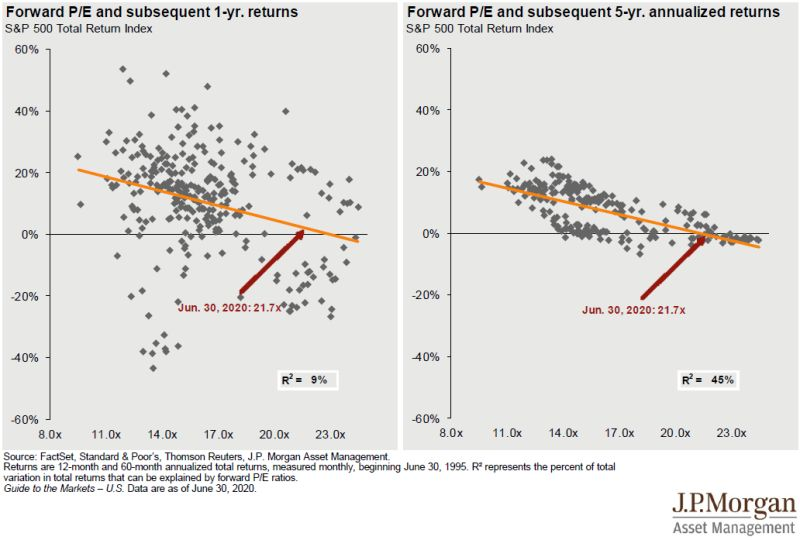

In the chart below, Jeremy Grantham's GMO next seven-year return forecast for asset classes. As you can see, they are not very bullish stocks or bonds, with emerging value being the only notable exception.