6 min read

(EP. 29) Should you Invest with the Market at Highs?

By: David DeWitt, CFP® May 3, 2021 9:53:54 AM

Welcome to the Invest Smarter podcast. On this show, we aim to leave you a smarter investor by the end of every episode. We will simplify investing, provide actionable ideas, and discuss timeless investing wisdom.

In this episode, we talk about whether or not you should invest when the market is at highs. Just thinking about whether or not to invest when the market is at highs means you are engaging in market timing, and we know throughout history that humans are simply not good at timing markets. Markets are incredibly complex, and every transaction has a seller and buyer, and both are humans, or algorithms designed by humans, and humans are emotional and vulnerable to irrational decision making.

The Average Equity Fund Investor still underperformed the S&P 500 by 1.31% for the year in 2020 according to Dalbar. And this was actually a great year for the average investor, the gap is usually more like 2 to 3%. But what makes up the difference? Emotions and attempting to time the market.

Consider these scenarios ranging from 1926 to 2000, where each investor begins with 1,000.

The first investor can’t tolerate risk and buys treasury bills. The end result is $16,644

The second investor knows her time horizon is long and puts its all in stocks. Her end result is $2,562,976

The third investor thinks he’s smart and tries to time the market. The end result is that he was out of the market during the 40 best months. That’s 40 months out of 900. He ends up with $15,050, worse off than the guy who just bought treasuries for peace of mind.

So with the market has made a handful of new highs in 2021 alone, what should you do if you have a chunk of cash you want to invest?

What you should definitely not do is wait for a correction before you make any moves.

Imagine an investor who sold before the march 2020 crash. You felt really, really smart. The crash happened so fast and recovered so fast that this investor thought, gee this doesn’t make sense, I’m going to wait for a 10% correction to buy back in. That investor is still not in the market. And the market is 26% higher than when he “smartly” sold. What’s he going to do now?

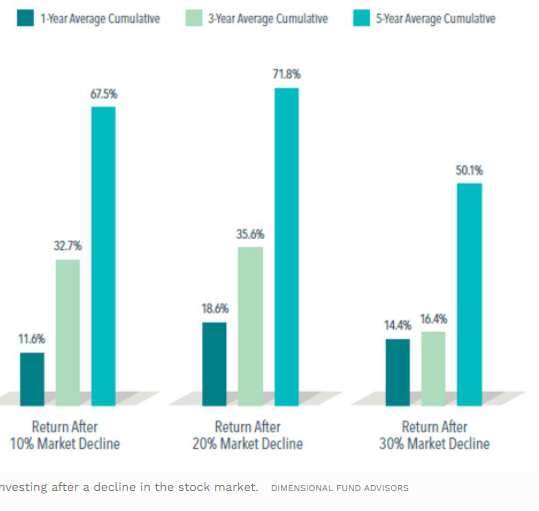

Research from JP Morgan actually shows that investing at all-time highs actually produces higher average returns over the next 1, 3, and 5 years as compared to investing on any random day.

Investing is not about timing the market, but rather time in the market. And your decisions should be based on your time horizon, not short-term fluctuations in the market.

Look at the US stock market like an at-bat in baseball, as we all know this average is the % of the time you hit the ball and reach base, batting average for the stock market could be viewed as how often you earn a monetary gain over a calendar year. In the past 93 years, stocks have made gains 66% of the time on a calendar year basis. In those years, the stocks reported an increase, approx 87% of the time the historical return was greater than 5%.

The broad US equity market tends to trend higher over a long period and at generally reasonable rates of return when compared to generally accepted required retirement withdrawal rates (3-4%).

Research from BlackRock shows that if your risk of losing money decreases significantly the longer you are in the market. And also, it’s not a bad bet if you are only in the market for a month! The odds of positive returns after 1 month in the market are better than roulette, at 62% odds of a positive return. In the market for 15 years? You have a 99.8% chance of having a positive return.

Still worried about investing at the wrong time? There are things you can do about it.

Dollar-cost averaging

DCA can help reduce the risk that you are investing at the wrong time, and also make it easier to stomach investing a large sum of money as you do it slowly over time. Let’s say you have 100k to invest. You could invest 10k a month for 12 months. When the market is higher, you’ll be getting fewer shares at a higher price. When the market is taking a breather, you’ll be picking up more shares at a lower price. No matter what, just make sure you set your plan and stick to it.

Diversify

We have been talking about the S&P 500 in our examples as investors are familiar with it. But to reduce risk, you can also diversify outside of the large-cap US stocks. International stocks, small-cap, midcap, fixed income should all be considerations. If you are particularly intolerant to risk, the more diversification the better.

Tranches

Now, if you are faced with a situation where a large portion of capital needs to be deployed into the market (inheritance, sale of a business, rollover of a 401k), the solution would not be to wait for a significant market correction but if you felt particularly uncomfortable, you could allocate over a particular period of time piecemeal or tranches. Set a discipline, allocate your capital over several months or quarters until you are fully invested, this way you reduce your entry point risk or entering at a perceived high point.

Even if you have 50 years to invest, it’s important to manage the emotional effects of investing. Being in a slower growth asset allocation that allows you to stay invested with peace of mind is a lot better than taking on more risk than you can handle, as the inevitably leads to irrational decision making which can kill returns.

Articles Discussed:

Should I Invest When The Market Is High? Dispelling The Buy Low, Sell High Myth

Investors Reacted to Market Crisis in Unprecedented Fashion

Charts Discussed: