Navigating Retirement with ADHD: A Financial Planner's Guide

Retirement planning is a crucial aspect of financial stability, providing a comfortable and worry-free future for yourself, your partner if...

2 min read

Scott Frank CAIA, CPWA®

:

Aug 10, 2023 11:08:15 AM

Scott Frank CAIA, CPWA®

:

Aug 10, 2023 11:08:15 AM

ADHD is a unique ride, full of twists, turns, and unexpected detours. Your mind is always on the go, hopping from one exciting thought to another. But let's hit the pause button for a second and chat about something important that might be slipping through the cracks: your forgotten 401k accounts.

Yes, you heard it right! Your past jobs might have left behind treasure chests waiting to be discovered. Why is this happening, you ask? ADHD can make keeping track of these details quite a challenge. Let's break it down:

Too Many Details, Too Little Time: With ADHD, juggling multiple tasks can feel overwhelming. If you've changed jobs a lot, tracking those old 401k accounts can be like trying to keep tabs on a dozen squirrels at once.

Out of Sight, Out of Mind: It's easy to overlook those accounts when moving on to a new adventure. Research says that in 2021, an impressive ~$1.35 trillion in 401(k)s got lost!

Dazzling Choices, Paralyzing Decisions: ADHD can make decision-making tricky. Rolling over a 401k means more options, but how do you choose without feeling stuck?

Streamlining Chaos: ADHD thrives on excitement, but too many accounts can lead to chaos. Consolidating them into an IRA puts everything in one place. Less fuss, more control!

Tailoring Your Treasure Map: By moving to an IRA, you can invest in a way that suits you best. Think of it as customizing your treasure hunt.

Trimming Hidden Traps: Many folks don't realize the fees they're paying for their 401k. Don't let these hidden traps erode your treasure.

Navigating Life's Twists and Turns: Whether it's changing jobs or retiring, having your financial roadmap aligned helps you sail smoothly through life's twists.

Personal Guidance: Sometimes, a 401k plan feels like a maze. What you need is personalized financial advice to help you navigate.

Still, feeling a bit lost in the financial wilderness? Here's where an ADHD-focused financial planner comes in:

Wrap-Up: Your Money, Your Adventure!

Rediscovering old 401(k)s and making them work for you doesn't have to be overwhelming. Your ADHD doesn't define you; it makes you unique. With the right guidance, you can turn forgotten savings into an opportunity to chart your financial future. Happy treasure hunting! 🏴☠️

Retirement planning is a crucial aspect of financial stability, providing a comfortable and worry-free future for yourself, your partner if...

3 min read

Introduction Welcome to our latest discussion on a topic that affects us all - taxes. Today, we delve into the intricate world of tax reduction,...

1 min read

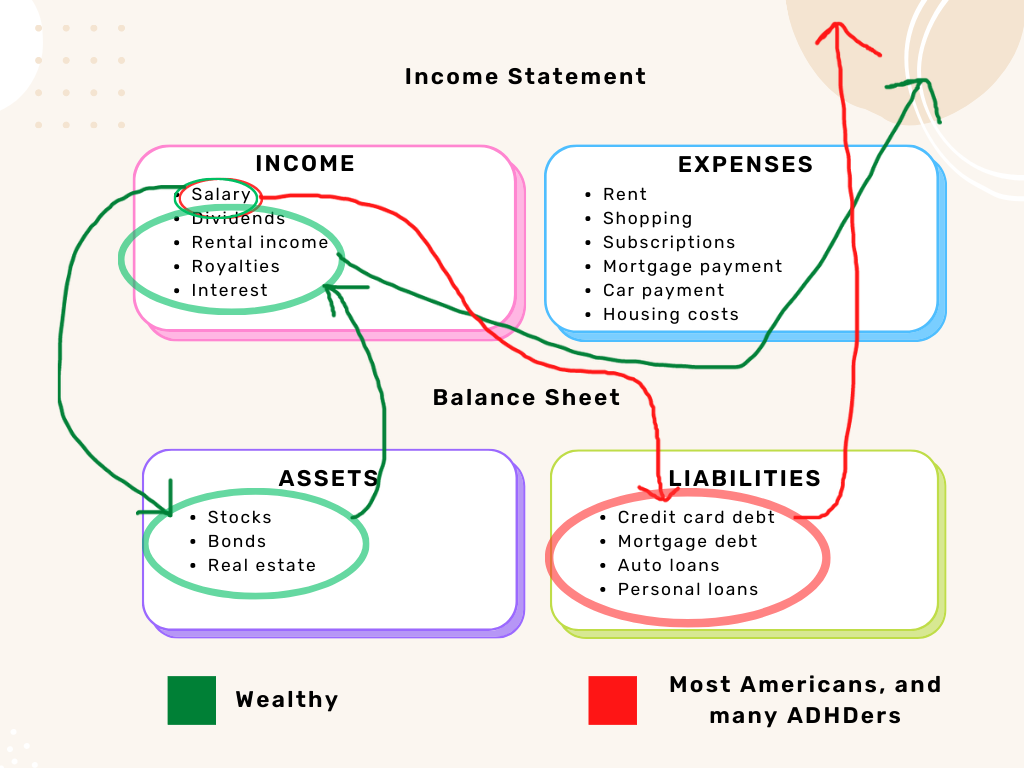

Society seems to teach us to go to school to get good grades so that we can go to a good college and get a good job. Now we can make money to become...